There are many Banks in Thailand and all are large institutions. There are many branches around Bangkok of all the Banks which may suprised some people coming from abroad where Banks are closing branches.

Thailand still relies heavily on cash although other payments are very common it’s not unusual to see someone in a bank withdrawing a large sum.

Key Commercial Banks in Thailand

- Bangkok Bank (BBL): One of the largest in Southeast Asia, offering robust corporate and personal banking.

- Kasikornbank (KBank): Known for strong digital banking capabilities and high adoption among small businesses and individuals.

- Siam Commercial Bank (SCB): A major, long-established bank offering comprehensive financial services, including insurance and investments.

- Krungsri Bank (Bank of Ayudhya): A key player with extensive branch networks, often partnered with Mitsubishi UFJ Financial Group.

- Krungthai Bank (KTB): A partially state-owned bank with a very large, nationwide branch presence.

- TMBThanachart Bank (ttb): Formed by the merger of TMB and Thanachart, focusing on consumer banking.

Thai Bank Accounts

These are impossible to open as a tourist and to be honest you don’t need one unless you are living here.

Thai Banks have been cutting down on the ease of opening a Bank account here in Thailand due to illegal account use often by people coersed into providing or opening accounts for other.

Thai Banks recently froze millions of accounts that where suspected as being used for money laundering. Given that opening a Bank accounts can be a lengthy process here in Thailand involving proving you live here, your visa status and more, many people used “agents” to open the accounts for them. A lot of these people are now having issues with their bank accounts until they prove their eligibility.

All the usual services are available from Thai Banks although often things that could be done quickly require a visit to the bank with the necessary paperwork. Recently I changed the payment method with my Mobile Phone provider to direct debit and it involved a trip to the phone company to get a form and fill it in, a trip to my bank and a trip back to the phone company. It then took up to 30 days to setup the direct debit. At home I could have done this online or on the banks app.

Having said the above Banking in Thailand is very good and some things are an advantage over back home. As an example the use of OTP (One Time Passcode) visa phone has been used in Thailand for many many years whereas it a recent addition in the UK. OTP started in the UK in 2006 but because widely adopted in Europe in 2018.

Banking Apps are very good and allow a wide range of features just like at home. Thai people use the App to pay by PromptPay (QR Code) very often.

ATM’s / Cash Points are everywhere in Thailand and are easy to use however be aware many people walk off without their card as unlike at home you get your cash first and then your card.

Cash deposit machines are widespread in Thailand and now require the use of OTP.

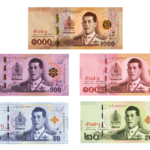

New polymer banknotes were introduced in March 2022 although older notes are still in current use. New polymer notes show the current King (Rama 10). Older notes show the previous King (Rama 9) and are still legal currency.